- Our services

Please fill in the information to request the full version

Request a full version of the program

- Afaky ERP System

Our agents

- About AFK

AFK Company - Afaqy Information Technology Founded in 2014. We work in the field of information technology and we have the experience, competence and precedent of business, which makes us proud to be an entity on which many institutions and companies of different activities depend, and to win the trust of many investors and business owners, as the tenth city has taken the size of our business as our headquarters. The largest gathering of industrial investment in Egypt) to be side by side with investors and business owners,

- Our previous work

We are pleased to provide our services in various technical fields in various countries of the Arab world

- Languages

- Our services

Please fill in the information to request the full version

Request a full version of the program

- Afaky ERP System

- About AFK

AFK Company - Afaqy Information Technology Founded in 2014. We work in the field of information technology and we have the experience, competence and precedent of business, which makes us proud to be an entity on which many institutions and companies of different activities depend, and to win the trust of many investors and business owners, as the tenth city has taken the size of our business as our headquarters. The largest gathering of industrial investment in Egypt) to be side by side with investors and business owners,

- Our previous work

We are pleased to provide our services in various technical fields in various countries of the Arab world

- Languages

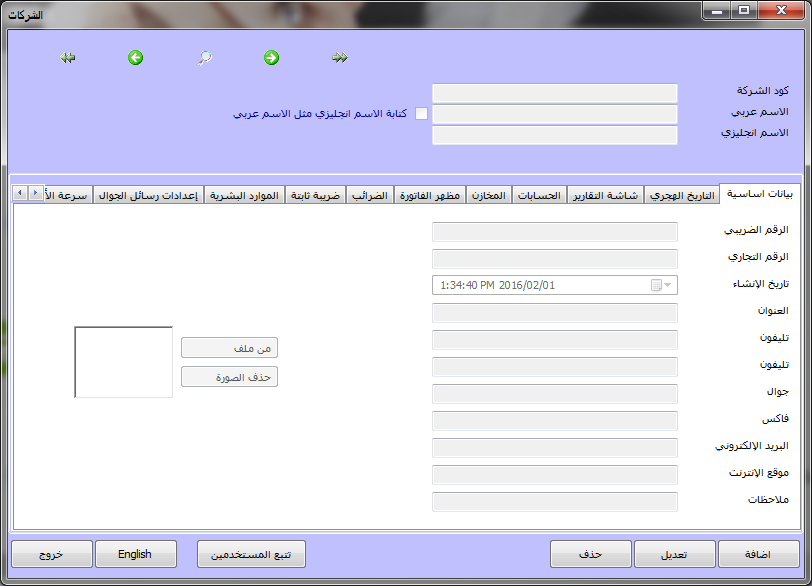

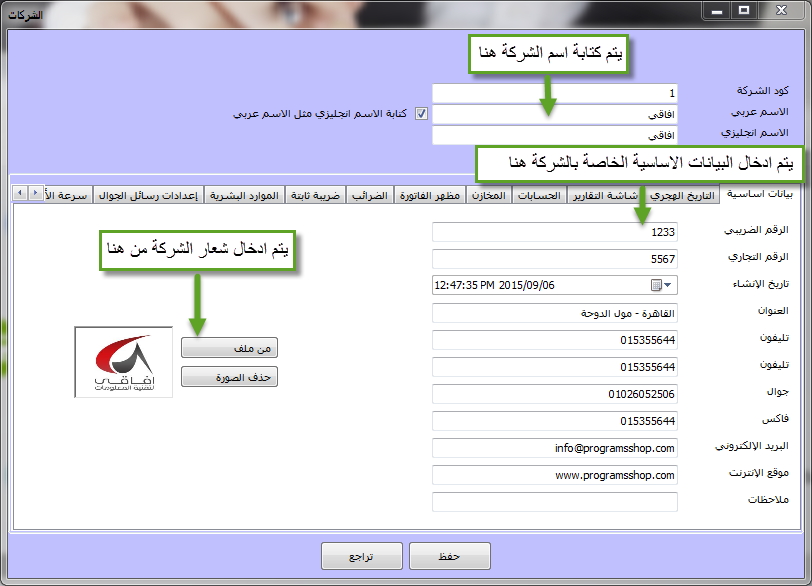

Corporate accounting software

Corporate Accounting Program - Explanation of the Companies Screen

Afaqy Corporate Accounting Program is a specialized program for managing commercial, service and industrial institutions and companies effectively and accurately, with ease and organization without error. Afaqy serves many commercial, service and industrial companies located in the Arab world and supports both Arabic and English languages.

The integrated Afaky system offers many advanced solutions in corporate accounting and technical facilities that make corporate accounting and their reports something that does not require much experience in lieu of the speed of research and the multiplicity of reports

Hijri date tab:

Then click on the Hijri date tab, and this screen will appear, enter the required data:

1- Select it if you want the fiscal year to be in the Hijri date .

2- Select it if you want the Hijri date to appear alongside the Gregorian date in the program screens .

3- Select it if you want to print the Gregorian date only .

4- Select it if you want to print only the Hijri date .

5- Select it if you want the Gregorian and Hijri date to be printed together

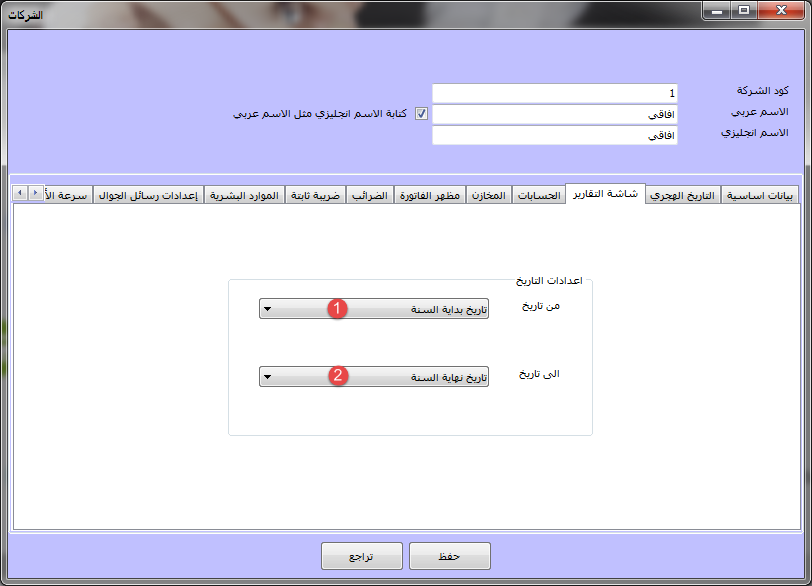

Report screen tab:

Then click on the Reports screen tab, and this screen will appear, enter the required data .

1- Enter the default settings for the start date of the reports, and there are three settings: :

* today's date

* year start date

* Specific date

2- Enter the default settings for the end date of the reports, and there are four settings: :

* today's date

* year start date

* Specific date

* Next day at a fixed time

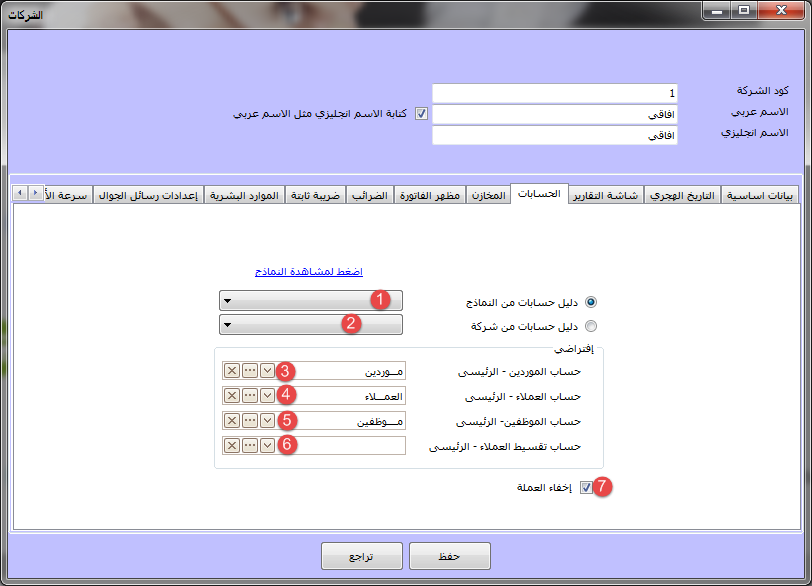

Accounts tab:

Then click on the accounts tab, and this screen will appear, enter the required data .

1- Select it if you want to import a chart of accounts from the forms

2- Select it if you want to import a directory of accounts from another company into the program

3- Choose the main supplier account in the chart of accounts

4- Select the main customer account in the chart of accounts

5- Select the main employee account in the chart of accounts

6- Choose a customer installment account – Main in the chart of accounts

7- Select it if you want the currency option to be hidden in the program screens

Stores tab:

Then click on the stores tab, and this screen will appear (We find that it contains many options that provide you with complete control and flexibility High management of your company in line with the nature of your work) Select the options you want by clicking on the box ![]() to be like this

to be like this ![]() .

.

To display the box of stores departments in sales and purchases invoices, goods receipt authorizations, and goods exchange permits .

To view box Item colors In sales and purchases invoices, goods receipt vouchers, and merchandise exchange vouchers .

To view box sorting items In sales and purchases invoices, goods receipt vouchers, and merchandise exchange vouchers .

To display the production date box in sales and purchase invoices, goods receipt authorizations, and goods exchange permits .

To display the expiration date box in sales and purchase invoices, goods receipt vouchers, and merchandise exchange vouchers .

To display the hierarchy of items in sales and purchase invoices, goods receipt authorizations, and merchandise exchange permits .

To display the discount box 1 In sales and purchases invoices, goods receipt vouchers, and merchandise exchange vouchers .

To display the discount box 2 In sales and purchases invoices, goods receipt vouchers, and merchandise exchange vouchers .

To display the discount box 3 In sales and purchases invoices, goods receipt vouchers, and merchandise exchange vouchers .

To display the pharmacy data field (Today's doses – days of use ) In sales and purchases invoices, goods receipt vouchers, and merchandise exchange vouchers .

To display the warranty history box in sales and purchase invoices, goods receipt vouchers, and merchandise exchange vouchers .

To display the possibility of hiding the price of any item in sales invoices.

To display the item conversion rate box in sales and purchase invoices

To make a fixed discount rate on sales invoices .

To determine the fixed discount rate .

To display the cube box in sales and purchase invoices, receipt of goods and goods exchange permits .

To select your barcode separator

To view box Item code In sales and purchases invoices, goods receipt vouchers, and merchandise exchange vouchers .

To prevent the variety from repeating the sequence of the varieties that have more than one sequence for the same variety, and each sequence is different from the other, such as mobiles, for example. .

To activate the minimum and maximum number of digits that make up the sequence

Determines the minimum number of digits that make up the sequence

Determines the maximum number of digits that make up the sequence

To display the length, width, and height boxes of sales and purchase invoices, goods receipt authorizations, and merchandise exchange permits

To display the order number box in the point of sale and restaurant management

To display the model box in sales and purchase invoices, goods receipt authorizations, and goods disbursement authorizations .

To display the motor number box in sales and purchase invoices, goods receipt authorizations, and goods exchange permits .

To display the guarantee percentage box in sales and purchase invoices, goods receipt permits, and goods exchange permits .

To display the box for the guarantee value in sales and purchase invoices, goods receipt authorizations, and goods exchange permits .

To display the development fee box in sales and purchases invoices, goods receipt permits, and goods exchange permits .

To display the chassis number box in sales and purchases invoices, goods receipt authorizations, and goods exchange permits .

To display the plate number box in sales and purchase invoices, goods receipt authorizations, and goods exchange permits .

Displays the delegate box at the level of each item in the sales invoice

To display the sponsors box in the sales invoice, which is for the installment program .

To prevent the possibility of writing or modifying the item code in the items screen .

To determine the end of the order number counter .

To determine the time of zeroing the dial number counter to start from the number 1

To prevent the possibility of selling below cost price

To display the lot number box in sales and purchases invoices, goods receipt authorizations, and merchandise exchange authorizations .

To make the quantity of items an integer without fractions

To close automatic cost tracking and rely on manual tracking only

To activate the maximum items feature, customers and suppliers ( Which is used to determine the maximum limits for certain items for the customer and the supplier )

Invoice appearance tab:

Then click on the invoice appearance tab, and this screen will appear

Select the options that are hidden from the bill by clicking on the box ![]() to be like this

to be like this ![]() .

.

To hide the sales representative check box from the sales invoice

To hide the currency check box from sales and purchase invoices .

To hide the source check box from sales and purchases invoices, goods receipt permits, goods exchange permits, and the source ( As a sales invoice when making a permission to exchange goods, and as a purchase order when making a purchase invoice ) .

To hide the part of the amounts and dates of payments due from sales and purchases invoices .

To hide the general expenses part “which is charged to the invoice as a whole” Sales and purchase invoices .

Hide the private expense section “Which is charged to the invoice for each item separately” Sales and purchase invoices .

To hide the free quantity box from sales and purchases invoices, goods receipt authorizations, and goods exchange permits .

To hide the added cost box from sales and purchases invoices, goods receipt permits, and goods exchange permits .

To hide the total box after deduction from sales and purchases invoices, goods receipt permits, and goods exchange permits .

To hide the barcode field from sales and purchase invoices, goods receipt permits, and goods exchange permits .

To hide the discount percentage box from sales and purchase invoices, goods receipt permits, and goods exchange permits .

To hide the quantity from sales and purchase invoices, goods receipt permits, and goods exchange permits .

To hide the unit box from sales and purchases invoices, goods receipt permits, and goods exchange permits .

To hide the total box from sales and purchases invoices, goods receipt permits, and goods exchange permits .

To hide the net box from sales and purchases invoices, goods receipt permits, and goods exchange permits .

To hide the store box from sales and purchases invoices, goods receipt permits, and goods exchange permits .

To determine the number of lines in sales and purchase invoices, goods receipt notes, and goods exchange permits .

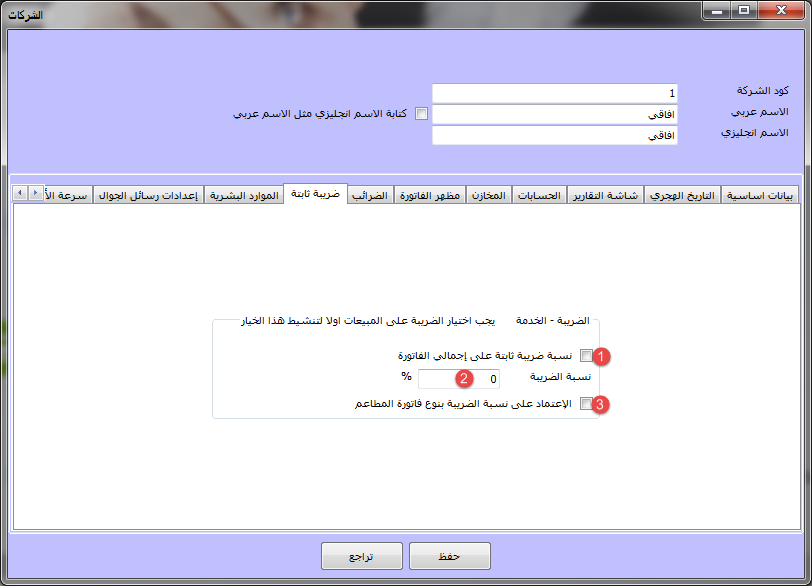

Tax tab:

Then click on the Taxes tab, and this screen will appear

Select the options you want by clicking on the box![]() to be like this

to be like this ![]() .

.

To activate the use of tax on purchase invoices

To activate the use of tax on purchase returns

To activate the use of tax on sales invoices

To activate the use of tax on sales returns

Displays the tax rate field on invoices

Displays the tax value field on invoices

To activate the use of “source tax deduction” on purchase invoices

To activate the use of “source tax deduction” On Purchase Returns

To activate the use of “source tax deduction” on sales invoices

To activate the use of “source tax deduction” on sales returns

Displays the percentage field “source tax deduction” in bills

Displays a value field “source tax deduction” in bills

To specify a constant ratio of“source tax deduction”

To activate the use of “Warranty tax” on purchase invoices

To activate the use of “Warranty tax” On Purchase Returns

To activate the use of “Warranty tax” on sales invoices

To activate the use of “Warranty tax” on sales returns

Displays the percentage field “Warranty tax” in bills

Displays a value field “Warranty tax” in bills

To activate the use of “add tax ” on purchase invoices

To activate the use of “add tax ” On Purchase Returns

To activate the use of “add tax ” on sales invoices

To activate the use of “add tax ” on sales returns

Displays the percentage field “add tax ” in bills

Displays a value field “add tax ” in bills

To activate the price incl. tax feature

To activate the tax rate dependence feature

HR tab:

Then click on the Human Resources tab

This screen will appear, select the options you want

By clicking on the box![]() to be like this

to be like this ![]() .

.

To activate the use of social security in salary entry .

To determine the percentage of social insurance from the basic salary .

To determine the percentage that the company pays for social insurance from the basic salary.

To determine the proportion of social insurance from the variable(Incentives - commissions - additional).

To determine the percentage that the company pays for social insurance from the variable.

To activate the use of health insurance in the salary entry .

To determine the percentage of social insurance from the basic salary .

To determine the policy of the number of working days for the employee, whether it is the actual number of days in the month or a specific number set by the company according to its policy

Specifies the number of working days in the event that the company has a special policy on working days .

To activate the use of work gain tax in salary entry .

Determining the exemption from the work-earning tax on the basic salary .

To determine the exemption limit for the work gain tax on the variable .

To activate the feature that the discount, overtime, penalties and bonuses are from the basic salary only .

To determine the start of the salary calculation day .

Performance tab:

Then click on the performance speed tab, and this screen will appear

Select the options you want by clicking on the box![]() to be like this

to be like this ![]() .

.

Not loading all suppliers while opening a purchase invoice

Not loading all customers while opening a sales invoice

Not to load all accounts while opening a daily entry

These options are activated to increase the speed of performance in the program

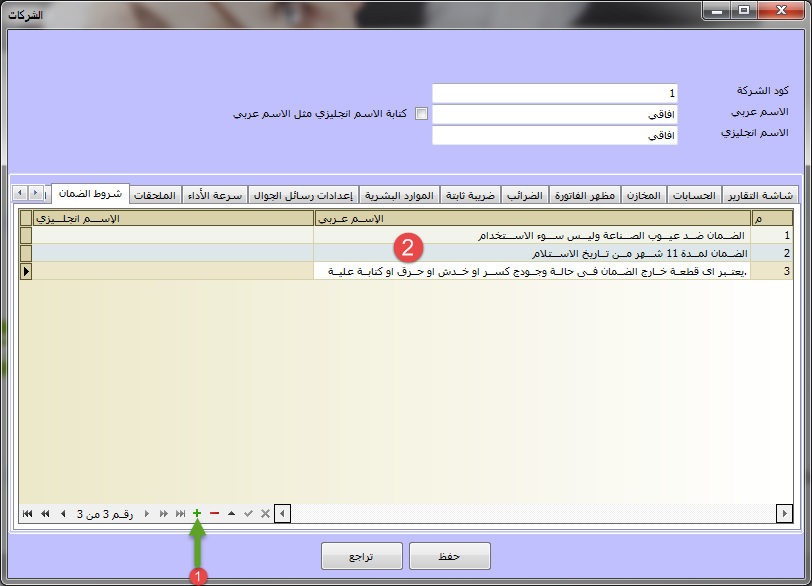

Accessories tab:

Then click on the accessories tab, and this screen will appear

Enter the following data, which is data for the barcode settings of the scale :

The beginning of the item code that has a weight is specified, and so on 200.

The number of characters of the item code that has a weight is determined, and so on 4 .

The divisor is determined by weight and is often 10000 .

US

US